Jeb Bush, Greece Crisis, and How to Help the Workers

That week where you’ve obliterated all previous fundraising records and amassed a campaign war chest of $114 million, but get yourself into trouble for saying other people need to work harder.

Oh you don’t have weeks like that?

Jeb Bush did.

…[W]e have to be a lot more productive. Workforce participation has to rise from its all-time modern lows. It means that people need to work longer hours and through their productivity gain more income for their families. That’s the only way we are going to get out of this rut that we’re in.

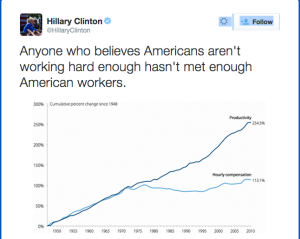

Bush has clarified he did not mean full time workers needed to put in more hours, but that people looking for more work need to be able to find it. That has not stopped the campaign of newly revealed political mastermind Hillary Clinton from sending some well-aimed Twitter barbs Bush’s direction.

I have an idea.

Let’s ask Greece.

Greece is currently in the end stages of a long social experiment in massive, unprofitable jobs programs, political graft, and crony capitalism. In addition to soul-sucking tax rates, Greece also ran up colossal debt during the loose lending years of the pre-2008 boom.

Despite taking in 50% of GDP in taxes, its government does not earn enough to fund its basic functions. And because Greece is incapable of paying its debts, no one is particularly interested in lending it any more money.

Its national railroad loses $4 million a day. Its citizens receive free university educations, but there are no jobs waiting for those who graduate. As a result, many of its best and brightest have already fled the country.

Its banks have been closed for two weeks and no one can take more than €60 per day out of the ATMs (which due to a shortage of €20 bills results in an effective limit of €50).

Hey, I have an idea, John Podesta. Let’s just pay them more!

Greeks agree! They rejected by a decisive margin a proposal for paying back all that debt that allowed their free university education, their jobs-program national railroad, their jobs-program schools and their generous early-retirement pension programs.

Tellingly, Greek’s hard left Prime Minister Alexis Tsipras almost immediately turned around and offered the same concessions anyway.

“The ‘No’ in the referendum appears to be turning into a ‘Yes’ from Tsipras,” Commerzbank analyst Markus Koch said.

Even Tsipras has seen the writing on the wall, glimpsed the final stages of a national government that has run out of other people’s money.

What does a government do when it doesn’t “earn” enough (in taxes) to fund its basic functions, much less make payments against its overwhelming debt, and cannot find new lenders to keep that financial house of cards standing?

Not work more hours! That would be mean.

Jeb Bush mean.

Well, Greece could just default. Of course, it won’t get any more loans after that, so it would have to live within its means: only spend what its citizens can afford to pay in taxes.

That’s mean too!

They could go off the Euro and print as much as their own currency as they want. At least one economist has argued that periphery Euro-nations like Greece have been harmed by the monetary policies of the European Central Bank, and that non-Eurozone nations able to set their own monetary policies fared better during the financial crises that began in 2008.

Moving to the drachma, however, is not without its difficulties. The drachma will fall in value against the euro. The more drachmas “printed” to service the debt, the more its will fall. Greece will still face the problem of wary lenders and having to live within its means.

Printing currency to service debt or grow an economy has limitations.

Perhaps Greeks could raise taxes. On the rich, natch.

But Greeks already face punishing tax rates. In addition to paying 22-45% in income taxes and another 44% in payroll taxes, they also pay a 23% VAT.

Why even look for a job?

It turns out Bush v.3.0 might be onto something.

His focus on “hours” was regrettable only because over the long run, advances in technology, innovation and specialization should theoretically allow increases in labor outputs without corresponding increases in hours worked. But he was right that the only way to increase the wealth of a nation is to increase the outputs of labor.

Simply infusing money into a system is not sufficient.

Don’t believe it? Imagine sitting on a virgin planet with all of Earth’s gold in the cargo hold of your space ship. Or being castaway on an uninhabited island with a duffle bag full of bank notes.

Are you rich?

It is not currency that makes people wealthy, but the outputs of labor that can be purchased with that currency. Increasing the available currency relative to the outputs of labor only precipitates a rise in prices (while real wages lag).

So what would it look like for the Greeks to be more productive? Half-clad single mothers chained in mines as sweat drips down their faces and IMF overlords crack whips over their heads? Children toiling in sweat shops as flies buzz around their demoralized brows?

No.

It means getting rid of the entrenched bureaucracy, bloated government, and corrupt police and political regimes that keep investors from making investments that result in jobs that allow people to work more hours. It means lowering the effective 90% tax rate individuals pay so that working those hours is remunerative. It means fewer cartels and licensing requirements that keep would-be entrepreneur sidelined leaving no jobs for all those free university graduates. It means getting rid of the minimum wage and price controls that prevent the economy from responding to supply and demand.

I’m not sure the Greeks have the political will for any of the foregoing, or whether the ECB/IMF negotiators have the imagination to focus on the necessary fundamental reforms to the Greek economy. Without them though, there is no way out of the morass. More loans in the lean years cannot help a country that overspends in the fat years.

Interestingly, even as the Eurozone debates Greece’s future, here across the pond, the national campaign spokesperson for Ted Cruz also took a swipe at Jeb Bush:

“It would seem to me that Gov[ernor] Bush would want to avoid the kind of comments that led voters to believe that Governor Romney was out of touch with the economic struggles many Americans are facing. The problem is not that Americans aren’t working hard enough. It is that the Washington cartel of career politicians, special interests and lobbyists have rigged the game against them.”

Paging the Syriza party, paging party of Syriza.

The Greeks don’t need higher taxes, more austerity or more bailouts. What they need is a functioning economy.